Accidents can happen at any time, and they often come with unexpected expenses that can strain your finances. This is where Aflac Accident Policy steps in to provide you with the financial protection you need during difficult times. Whether it's a slip and fall or a car accident, having the right coverage can make all the difference. In this article, we will delve into the details of Aflac Accident Policy, helping you understand how it works and why it is crucial for your financial well-being.

Aflac has been a trusted name in supplemental insurance for decades. The company’s accident policy is designed to complement your primary health insurance, ensuring that you receive additional support when you need it most. This policy is tailored to cover a variety of accident-related expenses, including hospital stays, surgeries, and rehabilitation costs.

Understanding the intricacies of Aflac Accident Policy can empower you to make informed decisions about your insurance needs. By the end of this article, you will have a clear picture of what the policy offers, how it benefits you, and how to enroll in the right plan for your situation.

Read also:Philip Oakey The Iconic Voice Behind The Human League

Table of Contents

- What is Aflac Accident Policy?

- Benefits of Aflac Accident Policy

- Coverage Options

- Eligibility Requirements

- How to Choose the Right Plan

- Claim Process

- Costs and Premiums

- Common Questions

- Why Choose Aflac?

- Conclusion

What is Aflac Accident Policy?

Aflac Accident Policy is a supplemental insurance plan designed to provide financial assistance in the event of an accident. Unlike traditional health insurance, which primarily covers medical bills, Aflac's policy pays cash benefits directly to you. This means you can use the funds for any purpose, whether it's covering medical expenses, paying off bills, or taking care of daily living costs.

One of the key advantages of Aflac Accident Policy is its flexibility. You receive a lump-sum payment, which allows you to allocate the money as you see fit. This policy is especially beneficial for those who may face significant out-of-pocket expenses following an accident.

How Does It Work?

When you purchase an Aflac Accident Policy, you select a plan that best suits your needs. In the event of an accident, you file a claim with Aflac, and if approved, you receive a cash benefit. The amount you receive depends on the specifics of your policy and the nature of the accident.

Benefits of Aflac Accident Policy

There are numerous benefits to choosing Aflac Accident Policy as part of your insurance portfolio. Here are some of the most significant advantages:

- Direct Cash Payments: You receive cash directly, giving you the freedom to use the funds for any purpose.

- Comprehensive Coverage: The policy covers a wide range of accident-related expenses, from emergency room visits to physical therapy.

- Supplemental Support: It complements your primary health insurance, ensuring you have additional financial protection.

- Simple Claims Process: Filing a claim with Aflac is straightforward and efficient.

Additional Perks

Aflac Accident Policy also offers several additional perks, such as:

- Accident-related disability benefits

- Accidental death benefits

- Coverage for accidental dismemberment

Coverage Options

Aflac Accident Policy offers various coverage options to suit different needs and budgets. Depending on your preferences, you can choose from individual plans or family plans. Additionally, you can customize your policy by adding riders for enhanced coverage.

Read also:Comprehensive Guide To Contractors License In California Requirements

Key Coverage Features

Here are some of the key features of Aflac Accident Policy:

- Hospital confinement benefits

- Accidental injury benefits

- Emergency transportation benefits

- Surgery benefits

Eligibility Requirements

To qualify for an Aflac Accident Policy, you must meet certain eligibility requirements. Typically, individuals between the ages of 18 and 65 can apply for coverage. However, some plans may extend eligibility to older applicants under specific conditions.

Who Can Apply?

Both individuals and groups can apply for Aflac Accident Policy. Employers often offer this policy as part of their employee benefits package, making it accessible to a wider audience.

How to Choose the Right Plan

Selecting the right Aflac Accident Policy involves assessing your needs and budget. Consider the following factors when making your decision:

- Your risk level for accidents

- Your current insurance coverage

- Your financial situation

Tips for Choosing

Here are some tips to help you choose the best plan:

- Compare different plans and their benefits

- Consider adding riders for extra protection

- Review customer reviews and ratings

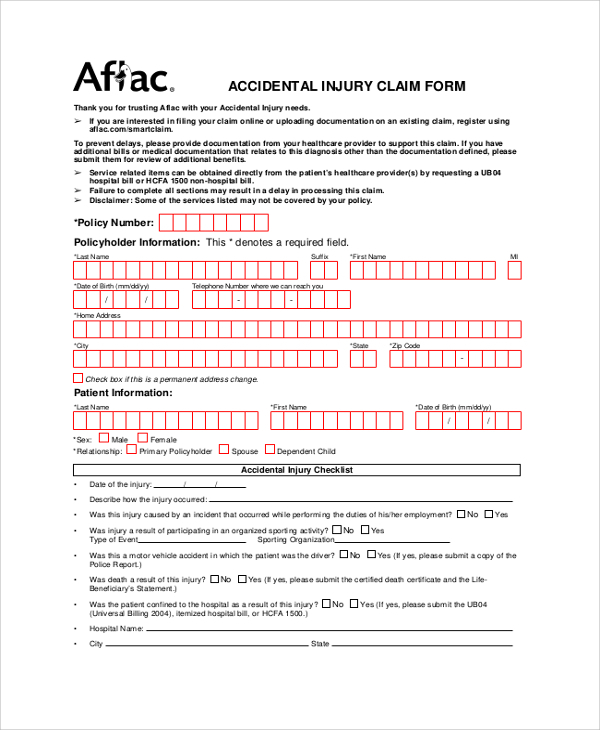

Claim Process

Filing a claim with Aflac Accident Policy is a straightforward process. Once you've experienced an accident, follow these steps:

- Contact Aflac to report the incident

- Gather all necessary documentation, including medical records

- Submit your claim online or via mail

- Wait for Aflac to review and process your claim

Common Claim Issues

Some common issues that may arise during the claim process include:

- Missing documentation

- Incomplete forms

- Delays in processing

Costs and Premiums

The cost of Aflac Accident Policy varies depending on several factors, including the level of coverage you choose, your age, and your location. Premiums are generally affordable, making this policy accessible to a wide range of individuals.

Factors Affecting Costs

Here are some factors that can affect the cost of your policy:

- Coverage amount

- Policy type

- Location

Common Questions

What Does Aflac Accident Policy Cover?

Aflac Accident Policy covers a variety of accident-related expenses, including hospital stays, surgeries, and rehabilitation costs. It also provides benefits for accidental death and dismemberment.

Is Aflac Accident Policy Worth It?

For many individuals, Aflac Accident Policy is a worthwhile investment. It provides additional financial protection during times of need, ensuring you have the resources to handle unexpected expenses.

Can I Cancel My Policy?

Yes, you can cancel your Aflac Accident Policy at any time. However, there may be penalties or fees associated with early cancellation, so it's important to review your policy terms carefully.

Why Choose Aflac?

Aflac is a well-established and reputable insurance provider with a strong track record of customer satisfaction. The company is known for its innovative insurance solutions and commitment to helping individuals and families achieve financial security.

Aflac's Reputation

Aflac has been recognized by various industry organizations for its excellence in customer service and product innovation. The company's dedication to quality and transparency has earned it a trusted place in the insurance market.

Conclusion

In conclusion, Aflac Accident Policy offers comprehensive coverage for unexpected accidents, providing you with the financial protection you need during challenging times. By understanding the benefits, coverage options, and eligibility requirements, you can make an informed decision about whether this policy is right for you.

We encourage you to take action by exploring Aflac Accident Policy further and considering how it can enhance your insurance portfolio. Don't hesitate to leave a comment or share this article with others who may benefit from the information. Together, let's build a more secure financial future.