Subprime loans for cars have become a vital financial option for individuals with less-than-perfect credit scores. These loans cater to those who might otherwise struggle to secure traditional financing for purchasing a vehicle. Whether you're looking to buy a new or used car, understanding how subprime auto loans work is essential for making an informed decision.

For millions of people, having access to reliable transportation is not just a convenience but a necessity. However, for those with credit challenges, securing a car loan can be daunting. Subprime loans for cars are designed to address this need by offering flexible terms and approval processes. This guide will delve into the intricacies of subprime auto loans, helping you navigate the complexities and make the best financial choices.

This article will provide detailed insights into the world of subprime loans for cars, including how they work, eligibility requirements, interest rates, and tips for managing them effectively. Whether you're a first-time buyer or someone looking to refinance, this guide will be your go-to resource for understanding subprime auto financing.

Read also:Tiffany From Adventure Time A Comprehensive Guide

Table of Contents

- What Are Subprime Loans for Cars?

- Eligibility Criteria for Subprime Auto Loans

- Understanding Interest Rates for Subprime Loans

- The Application Process for Subprime Loans

- Types of Subprime Car Loans

- Benefits of Subprime Loans for Cars

- Common Challenges with Subprime Auto Loans

- Tips for Managing Subprime Loans

- Alternatives to Subprime Loans for Cars

- Frequently Asked Questions

What Are Subprime Loans for Cars?

Subprime loans for cars are specialized financial products designed for borrowers with less-than-ideal credit scores. These loans are typically offered by lenders who specialize in working with individuals who may not qualify for traditional financing. While subprime loans can provide access to much-needed funds, they often come with higher interest rates and stricter terms.

Subprime borrowers are generally classified as those with credit scores below 620, although the exact threshold can vary depending on the lender. These loans are often used to finance the purchase of both new and used vehicles, providing flexibility for borrowers with diverse financial needs.

Key characteristics of subprime loans for cars include:

- Higher interest rates to account for increased risk.

- Flexible approval processes, often tailored to individual circumstances.

- Potential for credit score improvement over time through timely repayments.

How Subprime Loans Work

When you apply for a subprime loan for a car, lenders assess your creditworthiness based on factors such as credit history, income, and debt-to-income ratio. While credit scores play a significant role, lenders also consider other aspects, such as employment stability and existing financial obligations.

Eligibility Criteria for Subprime Auto Loans

While subprime loans are more accessible than traditional loans, there are still certain eligibility criteria that borrowers must meet. Understanding these requirements can help you prepare for the application process and increase your chances of approval.

Key Eligibility Factors

- Credit Score: Although subprime loans cater to individuals with lower credit scores, having a stable credit history, even with blemishes, can improve your chances.

- Income Stability: Lenders prefer borrowers with consistent income sources, such as full-time employment or verified self-employment.

- Down Payment: Providing a substantial down payment can reduce the loan amount and demonstrate financial responsibility.

Understanding Interest Rates for Subprime Loans

Interest rates for subprime loans for cars are typically higher than those for prime loans. This is because lenders view subprime borrowers as higher-risk investments. However, the exact interest rate you receive will depend on various factors, including your credit score, loan term, and the vehicle's value.

Read also:Guardians Of The Galaxy Cast The Ultimate Guide To Your Favorite Space Adventures

According to a report by Experian, the average interest rate for subprime auto loans in 2022 was approximately 14.36% for new vehicles and 19.91% for used vehicles. These rates can vary significantly based on individual circumstances and market conditions.

Factors Affecting Interest Rates

- Credit score and history.

- Loan term and amount.

- Vehicle type and age.

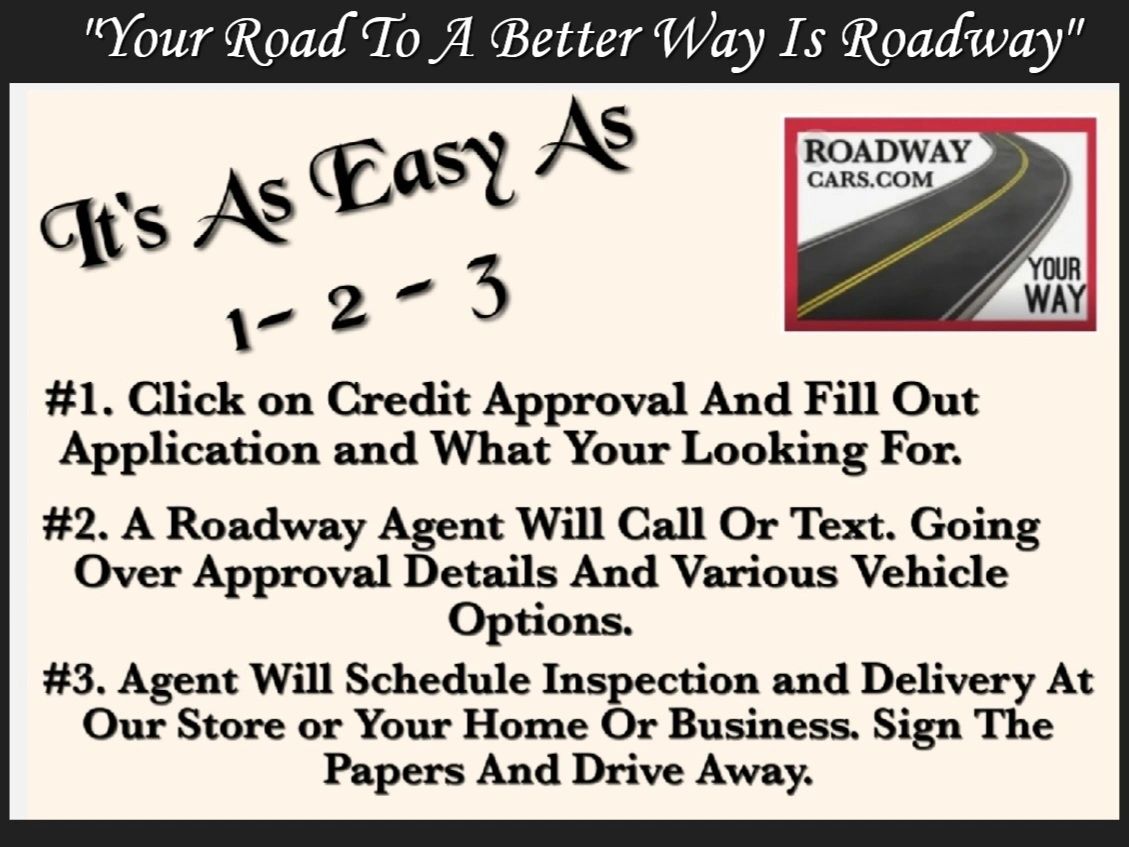

The Application Process for Subprime Loans

Applying for a subprime loan for a car involves several steps, from gathering necessary documents to finalizing the loan agreement. Understanding the process can help streamline your application and ensure a smoother experience.

Steps to Apply

- Gather Documentation: Prepare documents such as proof of income, identification, and residency verification.

- Research Lenders: Compare different lenders to find one that offers competitive rates and favorable terms.

- Submit Application: Complete the application form, ensuring all information is accurate and up-to-date.

Types of Subprime Car Loans

Subprime car loans come in various forms, each catering to different financial needs and preferences. Understanding the types of loans available can help you choose the one that best suits your situation.

New vs. Used Vehicle Loans

Subprime loans can be used to finance both new and used vehicles. New car loans often come with lower interest rates but require a larger down payment. Used car loans, on the other hand, may have higher interest rates but offer more flexibility in terms of vehicle selection.

Benefits of Subprime Loans for Cars

Despite the challenges associated with subprime loans, they offer several advantages that make them a viable option for many borrowers.

- Access to Financing: Subprime loans provide access to funds for those who might otherwise be denied traditional financing.

- Credit Improvement: Timely repayments can help improve your credit score over time, paving the way for better financial opportunities in the future.

- Flexibility: Subprime loans often come with flexible terms, allowing borrowers to tailor the loan to their specific needs.

Common Challenges with Subprime Auto Loans

While subprime loans offer numerous benefits, they also come with certain challenges that borrowers should be aware of.

- Higher Interest Rates: Subprime loans typically carry higher interest rates, which can increase the overall cost of the loan.

- Strict Repayment Terms: Missing payments can lead to penalties and further damage to your credit score.

- Loan Limitations: Some subprime loans may come with restrictions on vehicle selection or loan amounts.

Tips for Managing Subprime Loans

Successfully managing a subprime loan requires careful planning and financial discipline. Here are some tips to help you navigate the process:

- Create a Budget: Develop a budget to ensure you can comfortably meet your monthly payments.

- Monitor Credit Score: Regularly check your credit score to track improvements and identify areas for improvement.

- Explore Refinancing Options: Consider refinancing your loan once your credit score improves to secure better terms.

Alternatives to Subprime Loans for Cars

For those who prefer to avoid subprime loans, there are alternative financing options available. These alternatives may require more effort but can offer better terms and lower costs in the long run.

Co-Signing

Having a co-signer with a strong credit score can improve your chances of securing a traditional loan with better terms. However, this option requires trust and cooperation between both parties.

Frequently Asked Questions

What is the difference between subprime and prime loans?

Prime loans are offered to borrowers with excellent credit scores and typically come with lower interest rates and better terms. Subprime loans, on the other hand, cater to those with lower credit scores and carry higher interest rates to account for increased risk.

Can subprime loans improve my credit score?

Yes, consistently making timely payments on a subprime loan can help improve your credit score over time. However, missed payments can have the opposite effect, further damaging your credit.

Are subprime loans only for used cars?

No, subprime loans can be used to finance both new and used vehicles. The type of vehicle you choose may affect the loan terms and interest rates, but subprime loans are not limited to used cars.

Conclusion

Subprime loans for cars provide a valuable financial option for individuals with less-than-perfect credit scores. By understanding how these loans work, meeting eligibility criteria, and managing them responsibly, you can secure reliable transportation while improving your financial standing. Remember to explore all available options, compare lenders, and consider alternatives if necessary.

We encourage you to leave your thoughts and questions in the comments section below. Additionally, feel free to share this article with others who might benefit from its insights. For more information on financial topics, explore our other articles and resources.