In the world of finance, subprime auto lending has emerged as a significant player, offering vehicle financing options to individuals with less-than-perfect credit scores. This financial tool allows borrowers to access loans despite their credit challenges, but it comes with its own set of risks and rewards. Understanding how subprime auto lending works is crucial for anyone considering this option.

For millions of Americans and people globally, owning a car is not just a luxury but a necessity. Whether for commuting to work, running errands, or traveling, cars play a pivotal role in daily life. However, purchasing a car often requires financing, which can be challenging for those with less-than-ideal credit histories. Subprime auto lending bridges this gap by providing loans to individuals who might otherwise be excluded from traditional lending markets.

While subprime auto lending offers opportunities for borrowers, it also raises important questions about financial stability, consumer protection, and the broader economic impact. In this article, we will delve into the intricacies of subprime auto lending, explore its benefits and risks, and provide insights into navigating this financial landscape responsibly.

Read also:Who Was Josh Brolins Mother Exploring The Life And Legacy

Table of Contents

- What is Subprime Auto Lending?

- History of Subprime Auto Lending

- Who Qualifies for Subprime Auto Loans?

- Benefits of Subprime Auto Lending

- Risks Associated with Subprime Auto Lending

- How to Apply for a Subprime Auto Loan

- Regulations and Protections for Borrowers

- Impact on the Automotive Industry

- Future of Subprime Auto Lending

- Conclusion and Actionable Insights

What is Subprime Auto Lending?

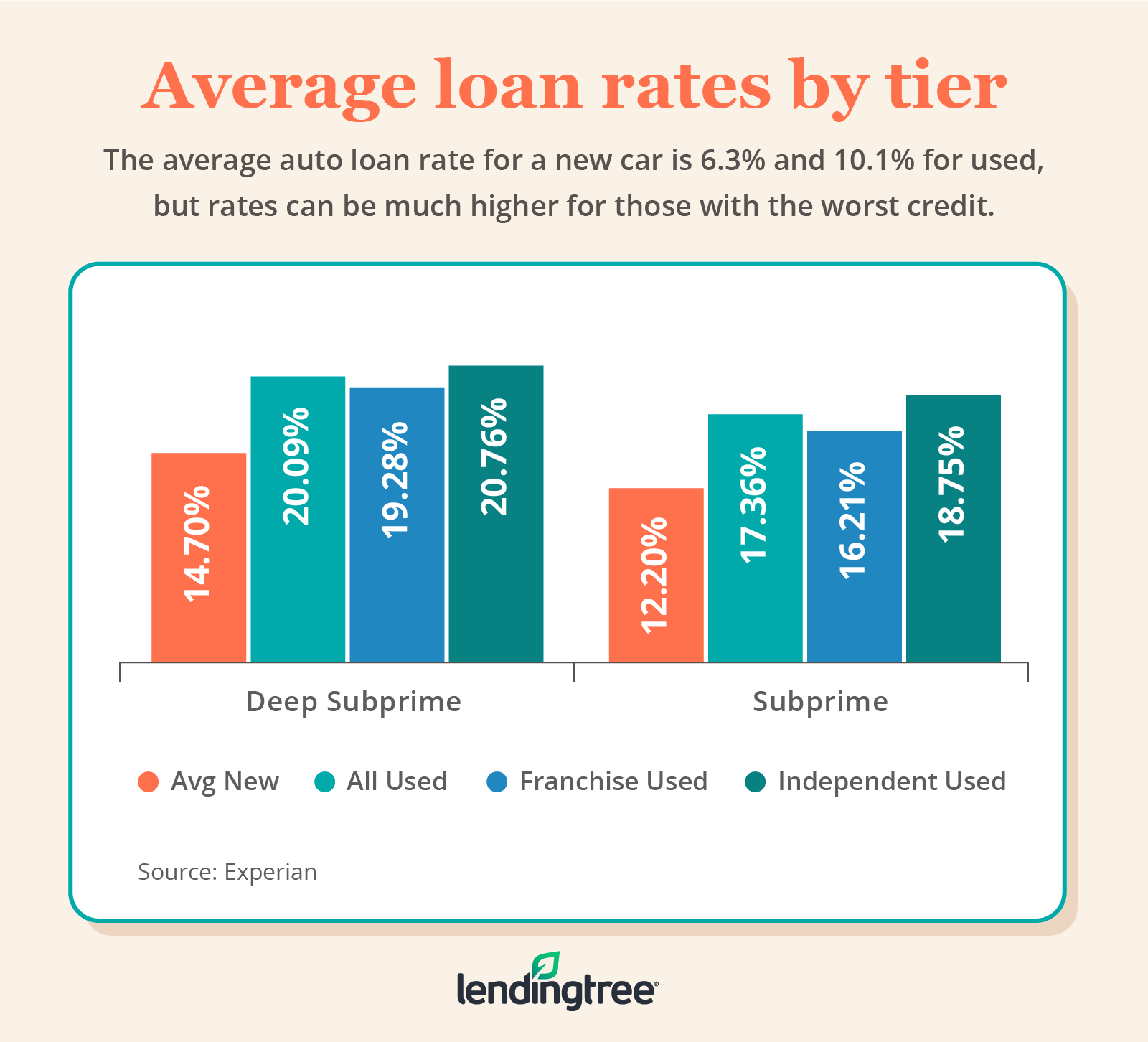

Subprime auto lending refers to the practice of extending auto loans to borrowers with credit scores that fall below traditional lending standards. These loans are designed for individuals who may have a history of missed payments, bankruptcies, or other financial challenges. Despite their credit profile, subprime borrowers can still qualify for loans, albeit at higher interest rates to compensate for the increased risk to lenders.

Subprime loans typically involve higher interest rates, larger down payments, and shorter repayment terms compared to prime loans. However, they provide an opportunity for borrowers to improve their credit scores over time by making consistent payments. This type of lending is particularly important in markets where car ownership is essential for daily living and employment.

Key Characteristics of Subprime Auto Loans

- Higher interest rates to offset risk.

- Stricter repayment terms.

- Potential for credit score improvement.

History of Subprime Auto Lending

The origins of subprime auto lending can be traced back to the late 20th century, when lenders began expanding their services to include higher-risk borrowers. Initially, these loans were offered cautiously, but as the market grew, so did the competition among lenders. By the early 2000s, subprime auto lending had become a significant segment of the automotive finance industry.

However, the 2008 financial crisis exposed vulnerabilities in the subprime lending market, leading to stricter regulations and more cautious lending practices. Today, subprime auto lending continues to evolve, with advancements in technology and data analytics enabling lenders to better assess risk and offer more personalized loan options.

Key Milestones in Subprime Auto Lending

- 1990s: Initial expansion of subprime lending.

- 2008: Financial crisis highlights risks.

- 2010s: Regulatory reforms and technological advancements.

Who Qualifies for Subprime Auto Loans?

Subprime auto loans are typically offered to individuals with credit scores below 620, although the exact threshold can vary depending on the lender and market conditions. Borrowers with a history of late payments, defaults, or bankruptcies may still qualify, provided they meet other criteria such as stable income and employment.

Factors that lenders consider when evaluating subprime loan applications include income stability, debt-to-income ratio, and the ability to make a substantial down payment. While credit score is a critical factor, it is not the sole determinant of loan approval.

Read also:Emily Feld Age A Comprehensive Look At The Life And Achievements Of Emily Feld

Eligibility Criteria for Subprime Auto Loans

- Credit score below 620.

- Stable income and employment history.

- Ability to make a down payment.

Benefits of Subprime Auto Lending

Subprime auto lending offers several benefits to borrowers, including the ability to purchase a vehicle despite credit challenges. One of the most significant advantages is the opportunity to rebuild credit scores by making timely payments. Additionally, subprime loans provide access to transportation, which is essential for employment and daily life.

Lenders also benefit from subprime auto lending by expanding their customer base and generating higher returns through interest payments. However, the success of subprime lending relies heavily on responsible borrowing and lending practices.

Top Benefits of Subprime Auto Lending

- Access to transportation for those with credit challenges.

- Opportunity to rebuild credit scores.

- Higher returns for lenders.

Risks Associated with Subprime Auto Lending

While subprime auto lending provides opportunities, it also comes with significant risks. Borrowers face the challenge of high interest rates, which can lead to substantial debt if payments are missed. Additionally, the risk of repossession is higher for subprime borrowers, as defaulting on a loan can result in the loss of the vehicle.

Lenders also face risks, including higher default rates and potential losses if borrowers fail to repay their loans. To mitigate these risks, lenders often employ strict underwriting standards and require larger down payments from subprime borrowers.

Common Risks in Subprime Auto Lending

- High interest rates for borrowers.

- Risk of repossession for defaulting borrowers.

- Potential losses for lenders due to defaults.

How to Apply for a Subprime Auto Loan

Applying for a subprime auto loan involves several steps, starting with a thorough evaluation of your financial situation. Before submitting an application, gather all necessary documents, including proof of income, employment verification, and credit reports. Research potential lenders and compare their terms and conditions to find the best option for your needs.

Once you have selected a lender, complete the application process, which typically includes a credit check and income verification. Be prepared to make a down payment and discuss repayment terms with the lender. Transparency and honesty during the application process can improve your chances of approval.

Steps to Apply for a Subprime Auto Loan

- Gather necessary financial documents.

- Research potential lenders and compare terms.

- Submit a complete application with all required information.

Regulations and Protections for Borrowers

In response to the risks associated with subprime lending, governments and regulatory bodies have implemented various protections for borrowers. These include caps on interest rates, restrictions on predatory lending practices, and requirements for transparent disclosure of loan terms.

Borrowers are encouraged to familiarize themselves with these regulations and seek legal advice if they encounter unfair practices. Consumer protection agencies also provide resources and support for individuals facing challenges with subprime loans.

Key Regulations Protecting Subprime Borrowers

- Caps on interest rates and fees.

- Prohibition of predatory lending practices.

- Transparent disclosure of loan terms.

Impact on the Automotive Industry

Subprime auto lending has had a profound impact on the automotive industry, driving sales and expanding the market for vehicle manufacturers and dealerships. By enabling more individuals to purchase vehicles, subprime lending has contributed to the growth of the industry, particularly in markets with high demand for personal transportation.

However, the rise of subprime lending has also raised concerns about the sustainability of the automotive market. As interest rates fluctuate and economic conditions change, the industry must adapt to ensure long-term stability and growth.

Effects of Subprime Auto Lending on the Automotive Industry

- Increased vehicle sales and market expansion.

- Challenges related to economic fluctuations.

- Need for sustainable lending practices.

Future of Subprime Auto Lending

The future of subprime auto lending will likely be shaped by advancements in technology, changes in regulatory environments, and evolving consumer preferences. As data analytics and artificial intelligence continue to improve, lenders will be better equipped to assess risk and offer personalized loan options to subprime borrowers.

Additionally, the rise of electric vehicles and alternative transportation methods may influence the demand for subprime auto loans. Lenders will need to adapt to these changes while maintaining responsible lending practices to ensure the long-term viability of the industry.

Trends Shaping the Future of Subprime Auto Lending

- Advancements in data analytics and AI.

- Emergence of electric vehicles and alternative transportation.

- Changes in regulatory environments.

Conclusion and Actionable Insights

Subprime auto lending plays a vital role in providing access to transportation for individuals with credit challenges. While it offers significant benefits, including the opportunity to rebuild credit scores, it also comes with risks that must be carefully managed by both borrowers and lenders.

To navigate the subprime auto lending market successfully, borrowers should thoroughly research potential lenders, compare terms and conditions, and maintain transparency during the application process. Lenders, on the other hand, must adhere to responsible lending practices and stay informed about regulatory changes to ensure the sustainability of the industry.

We encourage readers to share their experiences and insights in the comments section below. Additionally, feel free to explore other articles on our site for more information on financial topics and strategies for responsible borrowing. Together, we can build a more informed and empowered financial community.