In today's financial landscape, subprime auto loans have become a crucial option for individuals with less-than-perfect credit scores who need to finance a vehicle. Whether you're buying a car for the first time or replacing an old one, understanding how subprime auto loans work is essential. These loans are designed to cater to borrowers who may not qualify for traditional financing due to credit challenges, but they come with their own set of risks and benefits.

Subprime auto loans are more than just a financial tool; they can also be an opportunity to rebuild credit and gain access to better financial options in the future. However, it's important to approach these loans with caution and knowledge. This guide will delve into everything you need to know about subprime auto loans, including how they work, their advantages and disadvantages, and tips for securing the best terms possible.

By the end of this article, you'll have a comprehensive understanding of subprime auto loans and how they fit into the broader context of personal finance. Let's dive in and explore this critical financial product that millions of Americans rely on every year.

Read also:Bulbasaur Evolution Level A Comprehensive Guide For Pokeacutemon Enthusiasts

Table of Contents

- What Are Subprime Auto Loans?

- How Do Subprime Auto Loans Work?

- Who Qualifies for Subprime Auto Loans?

- Benefits of Subprime Auto Loans

- Challenges and Risks

- How to Get the Best Subprime Auto Loan

- Loan Terms and Rates

- Alternatives to Subprime Auto Loans

- Credit Rebuilding Through Subprime Loans

- Tips for Managing Subprime Auto Loans

What Are Subprime Auto Loans?

Subprime auto loans are specialized financial products designed to assist individuals with lower credit scores in purchasing vehicles. Unlike prime loans, which are typically reserved for borrowers with excellent credit, subprime loans cater to those who may have experienced credit challenges, such as past bankruptcies or late payments.

These loans are characterized by higher interest rates to compensate lenders for the increased risk of lending to borrowers with less-than-ideal credit histories. Despite the higher costs, subprime auto loans provide a valuable opportunity for borrowers to gain access to transportation while also working toward credit improvement.

Key Features of Subprime Auto Loans

- Higher interest rates compared to prime loans.

- Targeted toward borrowers with credit scores below 620.

- Flexible repayment terms, often ranging from 24 to 72 months.

- Potential for credit rebuilding through timely payments.

How Do Subprime Auto Loans Work?

Subprime auto loans function similarly to traditional auto loans but with some key differences. Lenders assess borrowers' creditworthiness based on factors such as credit score, income, and debt-to-income ratio. Since subprime borrowers pose a higher risk, lenders often impose stricter conditions, such as larger down payments or shorter loan terms.

Additionally, subprime loans often come with higher interest rates to offset the lender's risk. However, borrowers can still benefit from these loans by adhering to the repayment schedule, which can help improve their credit scores over time.

Steps to Obtain a Subprime Auto Loan

- Determine your budget and the amount you can afford to borrow.

- Shop around for lenders offering competitive rates for subprime borrowers.

- Prepare documentation, including proof of income and residency.

- Submit your application and negotiate terms with the lender.

Who Qualifies for Subprime Auto Loans?

Qualification for subprime auto loans is based on several factors, with credit score being the most significant. Typically, borrowers with credit scores below 620 fall into the subprime category. However, other factors such as employment history, income stability, and existing debt levels also play a role in determining eligibility.

Lenders may also consider extenuating circumstances, such as recent improvements in credit behavior or a stable job history, when evaluating applications. This holistic approach allows some borrowers with lower credit scores to secure financing despite their credit history.

Read also:Discover The Enchanting Doc Martin Location In Cornwall

Eligibility Criteria

- Credit score below 620.

- Stable income and employment history.

- Ability to make a down payment (if required).

- Good standing with previous creditors (if applicable).

Benefits of Subprime Auto Loans

While subprime auto loans come with higher costs, they offer several advantages that make them an attractive option for certain borrowers. One of the primary benefits is the ability to secure financing despite a less-than-perfect credit history. Additionally, these loans provide an opportunity to rebuild credit by consistently making timely payments, which can lead to improved financial health in the long term.

Subprime loans also offer flexibility in terms of vehicle selection, allowing borrowers to choose from a wide range of options based on their needs and budget. This flexibility is particularly valuable for those in need of reliable transportation for work or family obligations.

Advantages of Subprime Auto Loans

- Access to financing for borrowers with lower credit scores.

- Opportunity to rebuild credit through consistent payments.

- Wide selection of vehicles to choose from.

- Flexible repayment terms tailored to individual needs.

Challenges and Risks

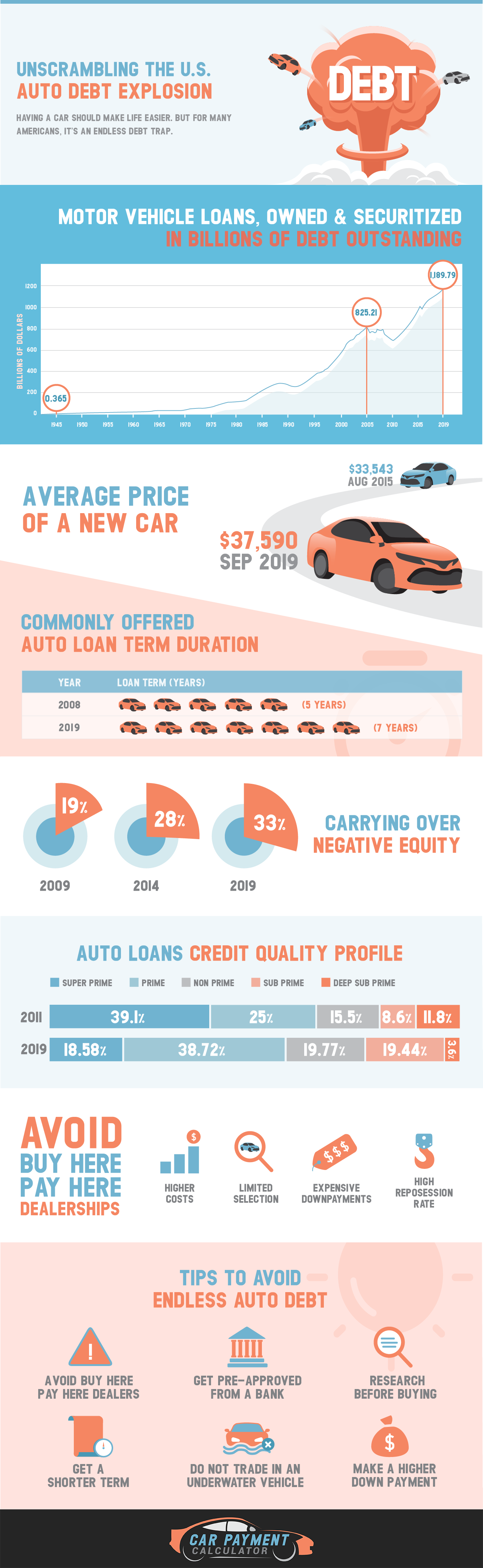

Despite their benefits, subprime auto loans come with significant challenges and risks. The most notable risk is the high interest rates, which can significantly increase the total cost of the loan. Borrowers must carefully assess their ability to meet monthly payments to avoid falling into financial difficulty.

Another challenge is the potential for predatory lending practices, where some lenders may exploit borrowers' financial vulnerabilities by offering unfavorable terms. It's crucial for borrowers to thoroughly research lenders and read the fine print before signing any loan agreement.

Risks Associated with Subprime Auto Loans

- High interest rates leading to increased loan costs.

- Potential for predatory lending practices.

- Increased risk of default due to financial strain.

- Impact on credit score if payments are missed.

How to Get the Best Subprime Auto Loan

Securing the best subprime auto loan requires careful planning and research. Start by assessing your financial situation and determining the maximum amount you can comfortably borrow. Next, shop around for lenders offering competitive rates and terms for subprime borrowers. It's also beneficial to improve your credit score as much as possible before applying for a loan, as even a small increase can lead to better terms.

Additionally, consider working with a credit union or local bank, as these institutions often offer more favorable terms compared to larger financial institutions. Finally, always read the loan agreement carefully and ask questions if anything is unclear to ensure you fully understand the terms and conditions.

Tips for Finding the Best Subprime Auto Loan

- Assess your financial situation and borrowing capacity.

- Shop around for lenders offering competitive rates.

- Improve your credit score before applying for a loan.

- Consider credit unions or local banks for better terms.

Loan Terms and Rates

Subprime auto loans typically come with higher interest rates compared to prime loans, with rates ranging from 10% to over 20% depending on the borrower's credit profile. Loan terms can vary from 24 to 72 months, with longer terms often resulting in lower monthly payments but higher overall costs due to increased interest accrual.

Borrowers should carefully evaluate loan terms and rates to ensure they align with their financial goals and capabilities. It's also important to consider any additional fees, such as origination fees or prepayment penalties, that may impact the total cost of the loan.

Factors Affecting Loan Terms and Rates

- Credit score and credit history.

- Down payment amount and vehicle value.

- Loan term length and repayment schedule.

- Market conditions and lender policies.

Alternatives to Subprime Auto Loans

While subprime auto loans are a viable option for many borrowers, there are alternative financing solutions worth considering. One option is to explore credit-builder loans, which are designed to help individuals improve their credit scores without the need for a vehicle purchase. Another alternative is to seek co-signers with better credit profiles to secure more favorable loan terms.

Additionally, some borrowers may benefit from leasing a vehicle instead of purchasing one outright. Leasing often requires lower monthly payments and may be a better fit for those with limited budgets or uncertain financial situations.

Alternative Financing Options

- Credit-builder loans for credit improvement.

- Co-signers with better credit profiles.

- Leasing as an alternative to purchasing.

- Peer-to-peer lending platforms.

Credit Rebuilding Through Subprime Loans

One of the most significant advantages of subprime auto loans is their potential to help borrowers rebuild their credit. By consistently making timely payments, borrowers can demonstrate financial responsibility and improve their credit scores over time. This improvement can lead to better financial opportunities in the future, such as securing lower interest rates on future loans or credit cards.

To maximize credit rebuilding potential, borrowers should focus on maintaining a positive payment history and avoiding missed payments. Additionally, keeping overall debt levels low and managing credit utilization effectively can further enhance credit improvement efforts.

Strategies for Credit Rebuilding

- Make timely payments consistently.

- Keep overall debt levels low.

- Monitor credit reports for errors or discrepancies.

- Consider credit counseling for additional support.

Tips for Managing Subprime Auto Loans

Successfully managing a subprime auto loan requires discipline and strategic planning. Start by creating a budget that accounts for all monthly expenses, including loan payments, to ensure you can meet your financial obligations without strain. Additionally, consider setting up automatic payments to avoid missed payments and potential penalties.

Regularly monitor your credit report to track improvements and address any issues promptly. Finally, stay informed about market conditions and lender policies, as this knowledge can help you make informed decisions about refinancing or renegotiating loan terms in the future.

Best Practices for Loan Management

- Create a budget to manage monthly expenses.

- Set up automatic payments to avoid missed payments.

- Monitor credit reports for accuracy and improvement.

- Stay informed about market conditions and lender policies.

Kesimpulan

Subprime auto loans provide a valuable financing option for individuals with lower credit scores who need access to reliable transportation. While these loans come with higher costs and risks, they also offer opportunities for credit improvement and financial growth. By understanding the intricacies of subprime loans and adopting best practices for management, borrowers can make informed decisions that align with their financial goals.

We encourage readers to share their experiences with subprime auto loans in the comments section below. Additionally, feel free to explore other articles on our site for more insights into personal finance and credit management. Together, we can build a stronger financial future for everyone.